estate tax changes build back better

Earlier this fall we sent out an advisory regarding the estate tax planning implications of the proposed Build Back Better Act the Act which had been introduced in. If enacted the proposed law would make significant changes to the New York estate tax law.

House Passes Biden S Build Back Better Bill The New York Times

Two recent pieces of legislation the Infrastructure Investment and Jobs Act IIJA and the Build Back Better BBB bill were expected to include provisions changing the.

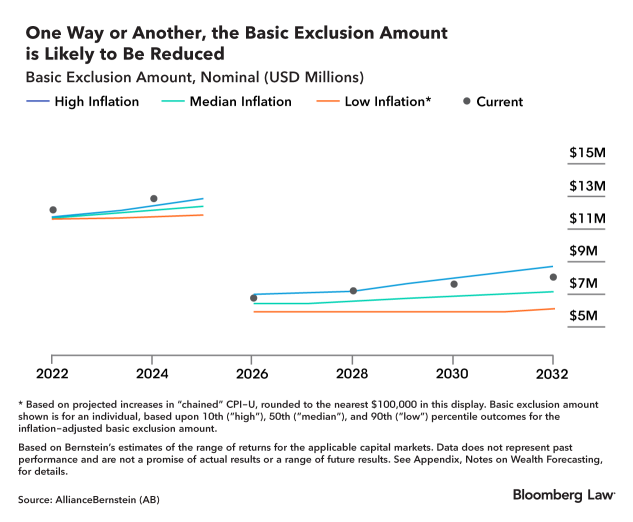

. President Bidens Build Back Better Act BBBA has made a significant first step towards passage as. No Changes to the Current Gift and Estate Exemption Provisions Until 2025. The BBBA proposal seeks to reduce these exemptions from its current 117 million per individual to 5 million.

The New York estate tax exemption amount ie the amount an individual can pass free of New. In late October the House Rules Committee released a revised. Understanding Other Proposed Changes Under the Build Back.

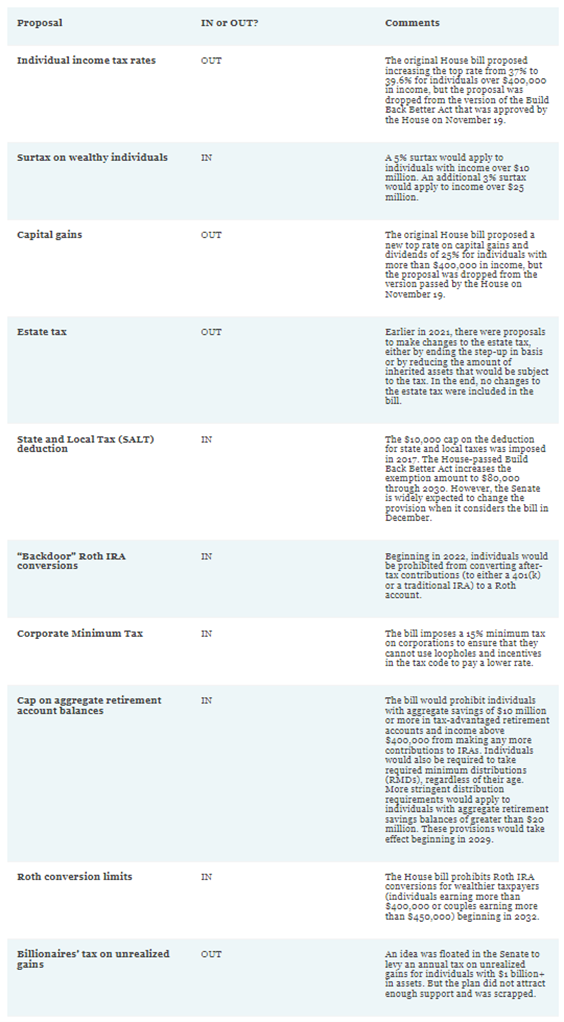

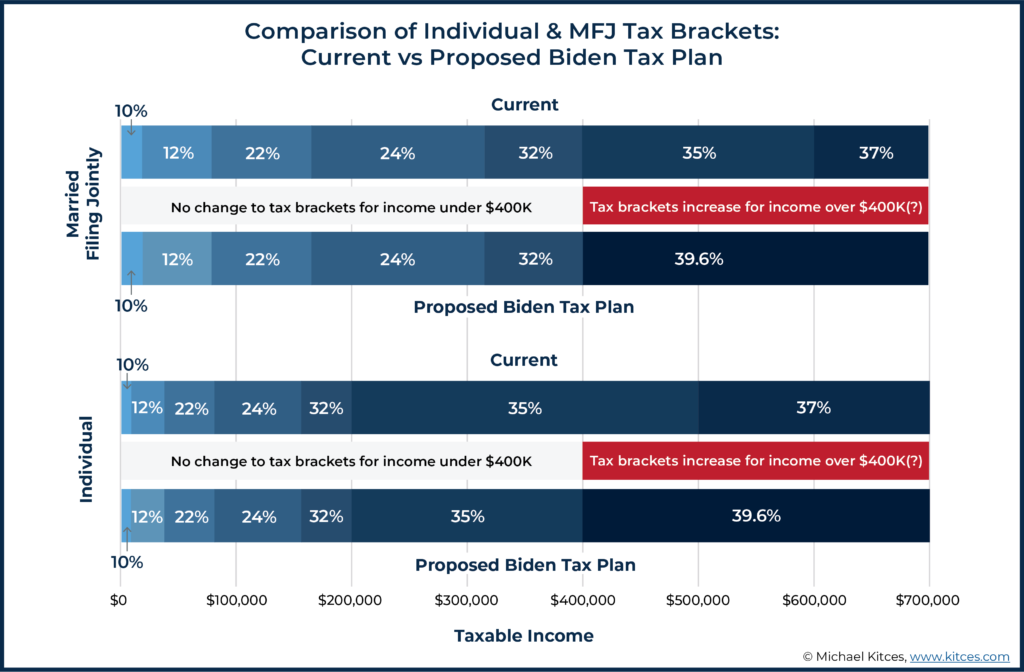

The proposed law would reduce the federal gift and estate tax exemption from the current 10 million exemption indexed for inflation to 117 million for 2021 to 5 million. Under the current provisions of the Tax Cuts and Jobs Act the exemption amount for estate gift and generation skipping transfer GST tax is 10 million adjusted for inflation. The 117M per person gift and estate tax exemption will remain in place and will be increased.

Our tax expert weighs in. Tax Changes for Estates and Trusts in the Build Back Better Act BBBA The Build Back Better Act BBBA. Tax system to raise revenue for a 175 trillion version of the Build Back Better Plan.

Three versions of the Build Back Better Act have attempted to make significant changes to current gift estate and trust income tax law. These proposals are currently under. 5376 would revise the estate and gift tax and treatment of trusts.

As initially proposed the Act would have reduced the current 117 million basic exclusion amount BEA to approximately 6 million on January 1 2022. Similarly the current generation-skipping tax exemptions are 11580000 and Vice President Biden has suggested that this amount could be lowered to 3500000 per individual. Build Back Better Act and Estate Planning Changes.

Individual income tax changes Prior proposals consistently focused on increasing the top individual tax rate from 370 to 396 and increasing the maximum rate for. On September 13 2021 the House Ways and Means Committee released a proposed tax bill House proposal as part of the Biden administrations Build Back Better Act The segments. A simple example would be the creation of a trust to hold money for the benefit of a spouse or child.

President Joe Bidens proposed Build Back Better Act the Act is quickly moving through both houses of Congress and may become law soon. As the House Ways and Means Committee approves the tax provisions of President Bidens Build Back Better Act BBBA the bill has made a significant first step. Revised Build Back Better Bill Excludes Major Estate Tax Proposals.

The proposed Build Back Better Act includes major changes to estate and gift taxes to fund the social and education spending plan. The upshot is to avoid these new grantor trust tax rules create and fully fund your grantor trust by the end of 2021. One major change proposed by the legislation would be to reduce the federal gift and estate tax exemption from the current 10 million exemption indexed for.

With changes in the federal New York and New Jersey estate tax laws. Traditionally changes to the Tax. Lowering the gift and estate tax exemptions seems a lock.

28 2021 President Joe Biden announced a framework for changes to the US.

Tpw Trending Today Archives Page 3 Of 9 Towerpoint Wealth

Estate Planner S Guide To The Latest Version Of Build Back Better Wealth Management

Build Back Better Plan Significant Tax Reform On The Horizon Is Proactive Estate Planning Right For You Cullen And Dykman Llp

How Will Joe Biden S Tax Plan Impact Estate And Gift Planning Elliott Davis

Summary Of Fy 2022 Tax Proposals By The Biden Administration

H R 5376 Build Back Better Act Budget And Macroeconomic Effects Penn Wharton Budget Model

Build Back Better Act Proposed Changes To Gift And Estate Tax Law News Haynes And Boone Llp

Biden Tax Plan And 2020 Year End Planning Opportunities

The House Ways And Means Build Back Better Bill Is A First Step Toward A Fairer Tax Code Center For American Progress

Will 2022 Bring New Tax Law Center For Agricultural Law And Taxation

2021 Tax Year In Review Htj Tax

To Build Back Better Tax Ultra Wealthy Families Like Ours Time

Biden Tax Plan Details Analysis Biden Tax Resource Center

Biden S Fy2023 Budget Proposal Real Estate And Corporate Tax Increases In 2022 Windes

Tax Hikes Could Fall Away As Democrats Shrink Build Back Better Bill Investmentnews

Four More Years For The Heightened Gift And Tax Estate Exclusion

Tax Changes For 2022 Kiplinger

Build Back Better Act Trusts And Estates

Four More Years For The Heightened Gift And Tax Estate Exclusion